After spending several sessions locked inside a tight, frustrating range, gold finally made its move and it did so when many traders least expected it. The breakout came during the Asian session, a period often associated with quieter price action rather than decisive momentum. Yet this time, Asia became the trigger point for a long-awaited directional shift.

For days, gold had been compressing within a narrow band, repeatedly testing support and resistance without committing either way. This kind of price behavior creates psychological tension. Traders grow impatient. Confidence erodes. Positions get lighter. When markets refuse to move, participants stop believing they will until they suddenly do.

The catalyst wasn’t a single headline, but rather exhaustion. Range-bound markets build pressure over time. Stops cluster above and below the range, liquidity thins, and conviction quietly rebuilds. When enough participants agree consciously or not that indecision can’t last, the breakout becomes less about news and more about release.

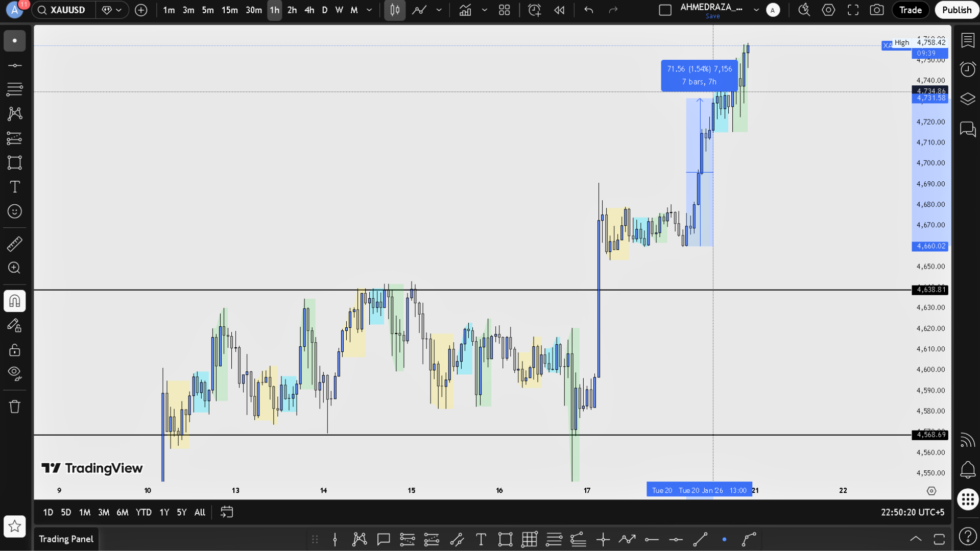

That release arrived during the Asian session, when gold surged approximately 90 points in a relatively short window. In pip terms, this move translated to roughly 900 pips, depending on contract structure a meaningful expansion after days of stagnation. The move was clean, impulsive, and directional, signaling that the market had finally chosen a side.

What made this breakout especially important was its timing. Asian session moves often struggle to carry into Europe and New York, but this one held. As the European session opened, price consolidated rather than retraced deeply a classic sign of strength. By the time New York came online, gold had extended further, pushing the total move to roughly 120–140 points from the original Asian lows, or around 1,200–1,400 pips into the New York session.

From a behavioural perspective, this sequence makes sense. Traders who had been sidelined during the range were forced to react. Short positions were squeezed. Late buyers chased confirmation. Momentum traders stepped in once structure validated the move. What began as a quiet Asian breakout evolved into a session-to-session continuation.

Importantly, this wasn’t emotional panic buying. The structure remained controlled. Pullbacks were shallow. That suggests participation rather than desperation a key difference when assessing sustainability.

In professional terms, the move reset short-term expectations. A market that refuses to move eventually forces repositioning, and once direction appears, participation accelerates. Gold didn’t just break a range it broke indecision.

As New York trading progressed, gold held its gains, confirming that the breakout was accepted rather than rejected. Whether this evolves into a broader trend or pauses for consolidation, the message is already clear: after days of hesitation, gold has found direction and the market is paying attention again.

In trading, silence often precedes movement. This time, the silence ended with a statement.